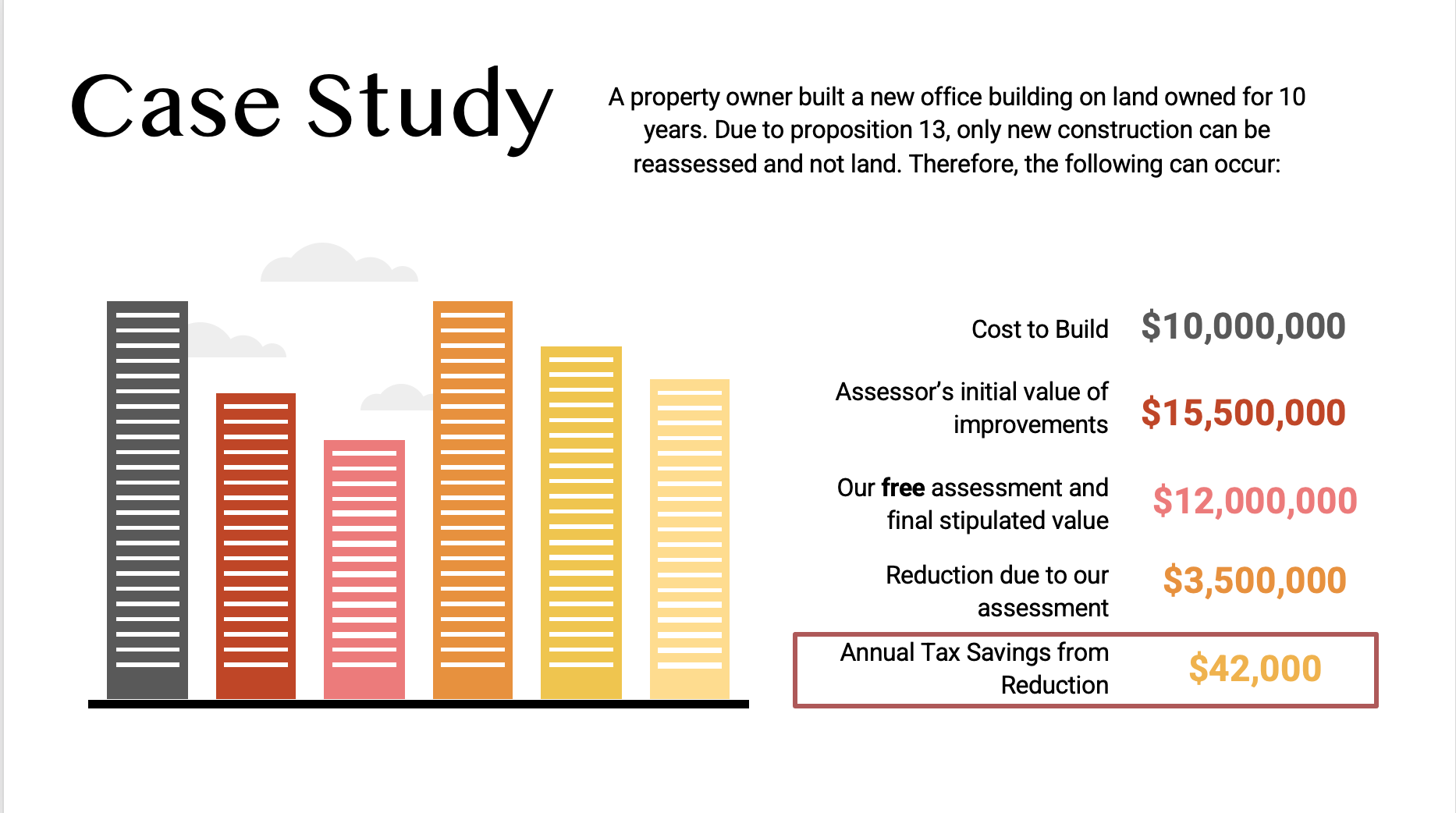

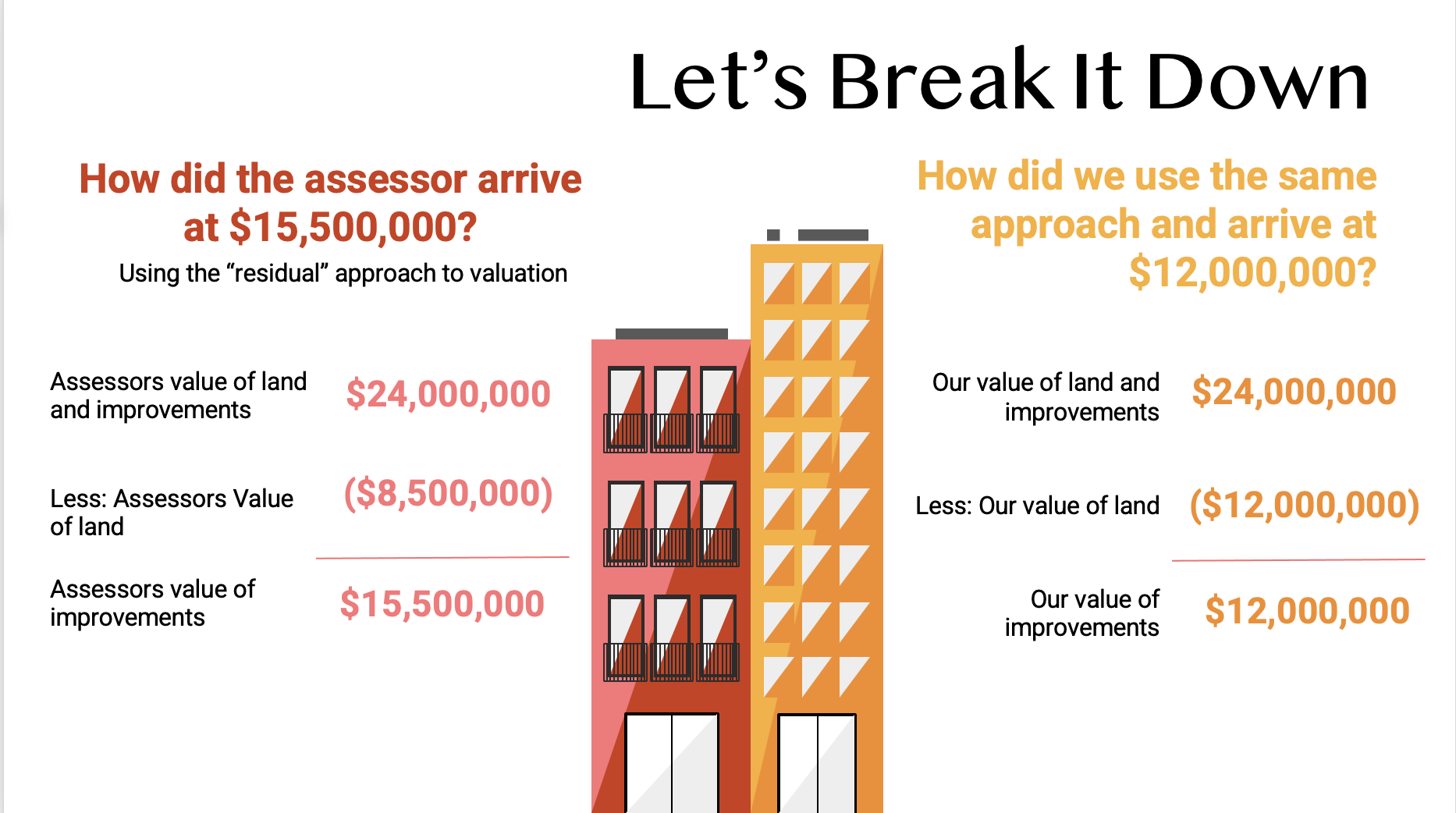

New Construction and Change of Ownership

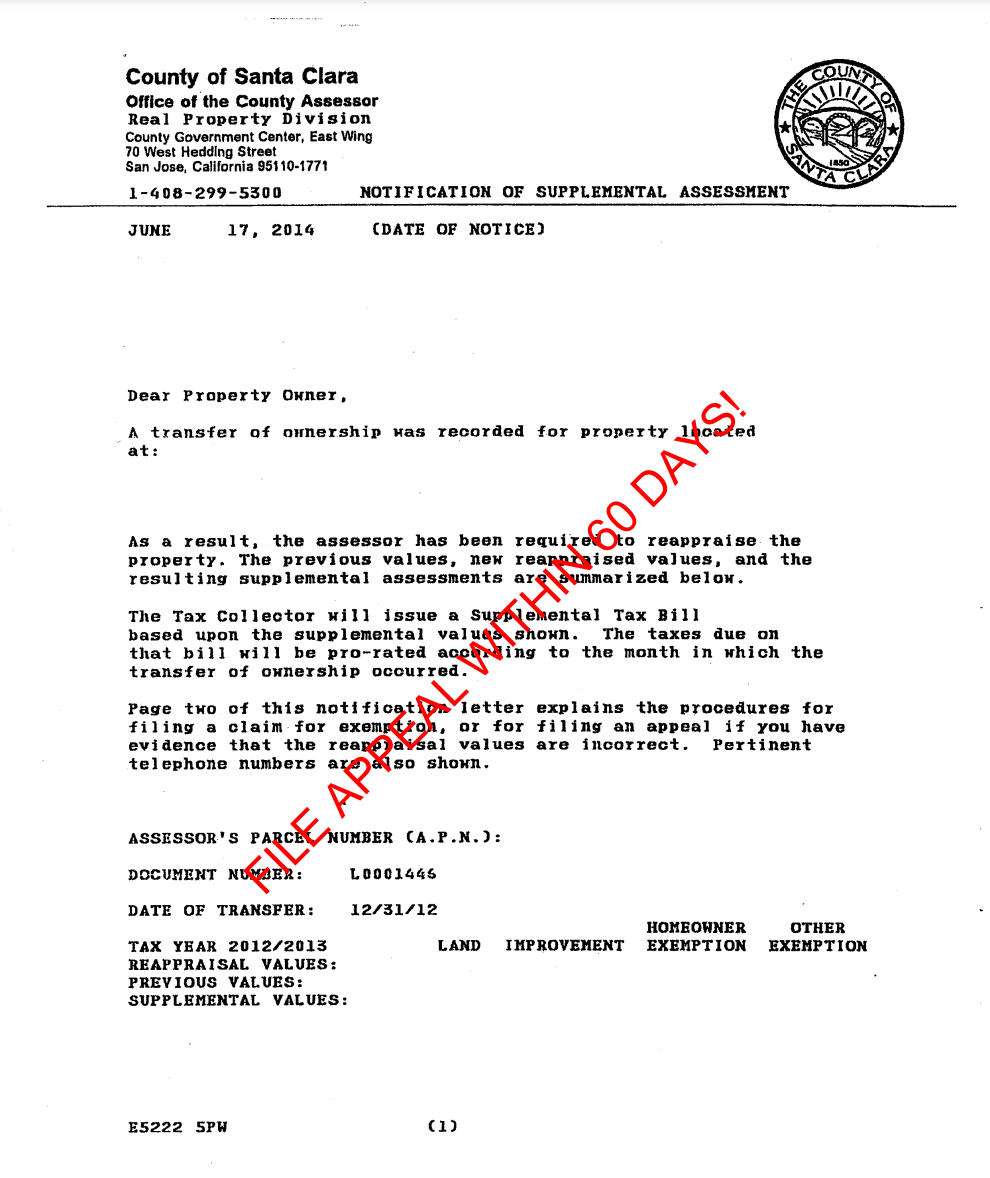

Properties that should always be reviewed are those that are reassessed after a death or a gift, or when new construction is completed. In these circumstances, you have to be on the lookout for the Notification of Supplemental Assessment, which shows the assessor’s new values. This is your chance to file an appeal. You only have 60 days from the date of the notice to file the appeal in order to have your eventual reduction effective as of the transfer or completion date. If you missed the 60-day window, you still have three years after the roll change to file your appeal. However, reductions from these appeals are effective beginning in the year that you file instead of the transfer or completion date. These appeals are filed during the regular window, which means you still have time to file by November 30 for most California counties. Regardless of when you file, reductions from these new “base year” appeals are permanent-Assessors can’t raise the new reduced values by more than the inflation factor, capped at 2% annually.

Conclusion: any reassessed property values from transfers or new construction in the last 3 years still have a chance at a permanent reduction, so get the appeal filed